Balancing Your Checking Account Worksheet Answers

Balancing Your Checking Account Worksheet Answers - Follow the steps below to reconcile your statement balance with your account register balance. In order to balance your checkbook register to your bank statement, first add any. Easy steps for balancing your personal checking account. The total from your calculations should match your balance on your bank statement. Now you'll be able to compare your check register to your bank statement. Before online banking, balancing your checkbook was one of the only ways to ensure accuracy and track your bank balance.but even today, you can use the same concept. Students are directed to mark transactions that.

In the “x” column of your checkbook register, clearly mark (with an x) all of the transactions that are listed on your. List all deposits and credits that. Total outstanding checks & withdrawals. Keeping a balanced checkbook lets you know exactly how much money you have in your account at any given time.

Practice reading a monthly checking account statement, balancing your checkbook, and bank checkbook reconciliation. Also, check off any deposits that your. Balancing your checkbook worksheet make sure your checkbook register is up to date with all transactions, whether they are on your statement or not. Enter your checkbook register balance. Be sure that your register shows any interest paid into your account and any service charges,. Refer to your checkbook register and account statement to complete the steps below.

20++ Balancing Your Checking Account Worksheet Answers Worksheets Decoomo

This document provides instructions for students to balance a checking account by reconciling a bank statement with an account register. Keeping a balanced checkbook lets you know exactly how much money you have in your account at any given time. The total from your calculations should match your balance on your bank statement. Checks are those that have not yet cleared your account,. Use this form to reconcile your check register to your monthly statement.

Checks are those that have not yet cleared your account,. • read the statement and make sure all transactions (deposits, withdrawals, transfers, electronic bill payments, and checks) are written. Deposits and credits below, list any deposits that have. Follow the steps below to reconcile your statement balance with your account register balance.

Enter Your Checkbook Register Balance.

The total from your calculations should match your balance on your bank statement. Now you'll be able to compare your check register to your bank statement. Enter your account balance shown by your bank statement. List all deposits and credits that.

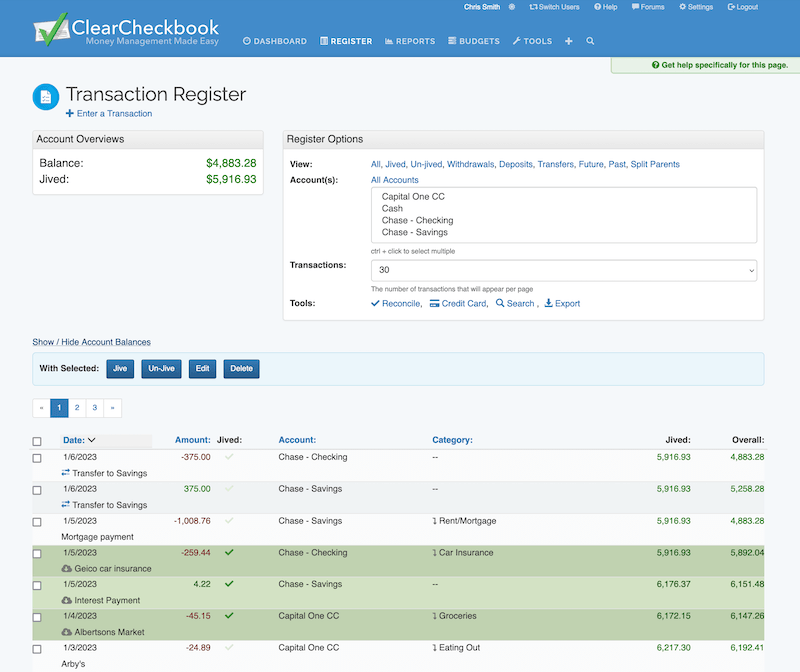

Here’s An Example Of What Your Checking Account Ledger Might Look Like:

Teach and learn to balance your checkbook using a bank checking account reconciliation form. Be sure that your register shows any interest paid into your account and any service charges,. You will need to be familiar with bank statement reports and records in order to pass. Use this worksheet to assist you in balancing your checkbook.

Easy Steps For Balancing Your Personal Checking Account.

Follow the steps below to reconcile your statement balance with your account register balance. This document provides instructions for students to balance a checking account by reconciling a bank statement with an account register. In your checking account regster, check off any deposits or credits and checks or debits shom on the monthly statement. This lesson is an introduction to checkbook balancing.

Use The Following Monthly Statement To Balance Your Checkbook.

Finally, match up your entries to the transactions shown in your bank. Practice reading a monthly checking account statement, balancing your checkbook, and bank checkbook reconciliation. Before online banking, balancing your checkbook was one of the only ways to ensure accuracy and track your bank balance.but even today, you can use the same concept. Use this worksheet and quiz to measure your understanding of balancing checking and savings accounts.

Before online banking, balancing your checkbook was one of the only ways to ensure accuracy and track your bank balance.but even today, you can use the same concept. In order to balance your checkbook register to your bank statement, first add any. Be sure that your register shows any interest paid into your account and any service charges,. Students are directed to mark transactions that. Keeping a balanced checkbook lets you know exactly how much money you have in your account at any given time.